Cryptocurrency taxes might seem overwhelming and complex at first glance, but the fundamentals are actually quite straightforward.

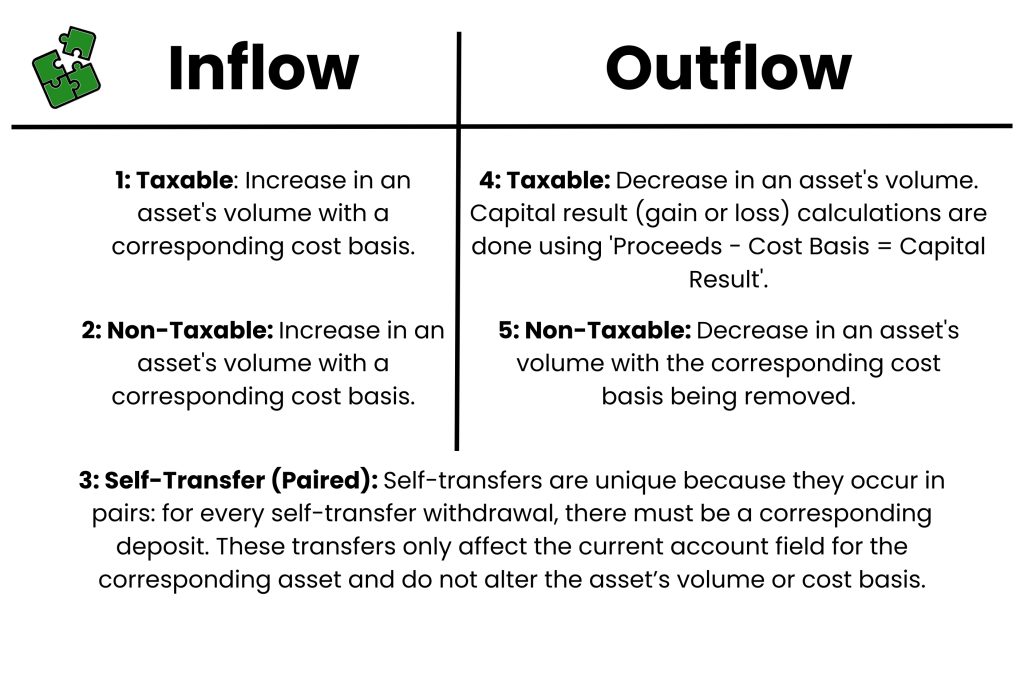

Cryptocurrency data can be categorized into one of five types, as shown below. It is classified as either an inflow or an outflow, and further divided into taxable, non-taxable, or self-transfer categories. Inflow self-transfers and outflow self-transfers are paired, which reduces the total number of classifications to five instead of six.

The overview below offers both a high-level perspective and insights into how these categories interact with the underlying data. For visual learns, a graphic is shown below:

Every cryptocurrency transaction fits into the grid above. To help solidify your understanding, an example dataset is provided below.

- A purchase of 1 ETH for $2,000 USD on Coinbase.

- This adds 1 ETH to your Coinbase account’s holdings with a cost basis of $2,000.

- A sale of 1 ETH for .1 BTC with a transaction value of $3,500 on Coinbase.

- This removes 1 ETH from your holdings and applies capital calculations as it is a taxable sale.

- Assuming this is the ETH from example #1, then the calculation is $3,500 – $2,000 = $1,500 gain.

- The .1 BTC is then added to the Coinbase account’s holdings with a cost basis of $3,500.

- A transfer of .1 BTC from Coinbase to a Ledger.

- There is a withdrawal of .1 BTC on Coinbase and a deposit of .1 BTC on Ledger.

- Here the asset’s properties would have a ‘current account’ field that would then get updated from Coinbase to Ledger.

- A gift of .1 BTC from Ledger to a friend.

- This removes the .1 BTC from the Ledger’s holdings and removes the cost basis of $3,500 as well.

- The donee (recipient of the gift) would inherit this cost basis and holding’s date if a gift letter is provided.

Understanding the grid shown above is key to grasping how cryptocurrency data operates. By aligning abstractions with the grid, you’ll gain insight into crypto tax calculations, how your crypto reconciliation should look, and the math behind optimizing your profits. We want you to fully grasp this grid, so we’ll also map out some common abstractions to help clarify things further!

Common abstractions:

- A trade of ETH for BTC is a combination of #2 (non-taxable inflow) and #4 (taxable outflow).

- A purchase of crypto is #2 (non-taxable inflow).

- A sale of crypto for fiat is #4 (taxable outflow).

- A gift of crypto is #5 (non-taxable outflow).

- Staking an asset is #3 (self-transfer), #1 (taxable inflow(s)), and then #3 (self-transfer).

- Staking here refers to sending an asset on chain to a contract, then receiving it back with additional units.

- Mining an asset is #1 (taxable inflow).

- Transferring an asset from Coinbase to Ledger is #3 (self-transfer).

All crypto tax software and reconciliation methods are based on the principles outlined above. While the terminology might vary, the underlying principles remain the same.

We hope this has clarified how cryptocurrency data works for you! If you’re still unsure, don’t worry—just reach out to us for help. We’re always here to assist you.