Table of Contents

Demystifying Ordinary Income: What You Need to Know

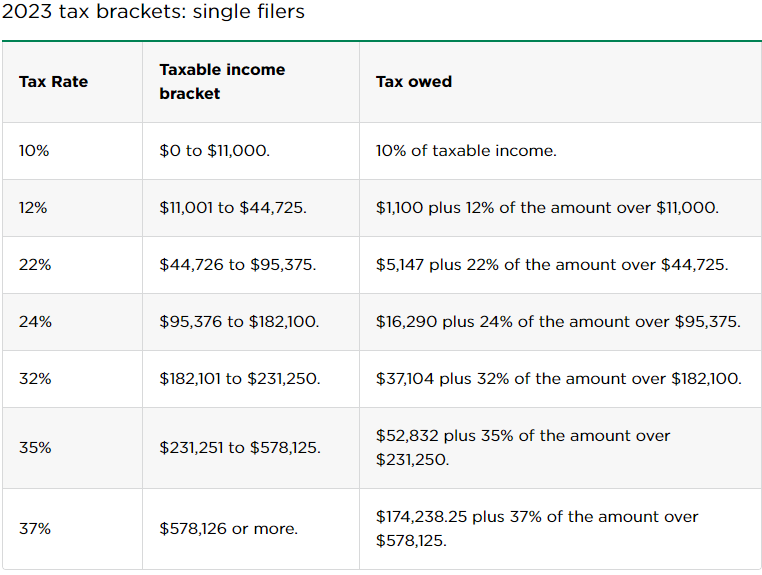

Ordinary income encompasses taxes on various sources such as wages, salary income, and short-term investment earnings. This category includes income from earned wages, rental income, as well as interest income from loans, CDs, and bonds (excluding municipal bonds). It’s subject to tax calculations based on your applicable tax bracket.

In the context of cryptocurrency, ordinary income typically takes a few specific forms. In each case, the asset received is treated as income based on its fair market value. These forms include staking and mining rewards, gambling income, airdrops, and income received for services rendered. From a data perspective, these are all treated similarly.

For instance, let’s consider the example of receiving 1 ETH when its fair market value is $2,000 per ETH. In this scenario, you would have an ordinary income event totaling $2,000. Your cost basis for the 1 ETH asset would be $2,000, and the holding date would correspond to when the asset was received.

It’s essential to understand that, irrespective of potential future asset value fluctuations, the total income derived from your dataset is subject to taxation based on the applicable tax brackets. This means that even in cases where asset values decline, you remain obligated to pay taxes calculated on the cumulative sum of all your income events.

To navigate this, a practical guideline is to consider selling 30% to 40% of the received asset immediately upon receiving it as an income event. This proactive approach helps you avoid the scenario where you’re left with a substantial income total, while the value of your assets has plummeted, potentially leaving you with insufficient resources to cover your sizable tax liability.

Demystifying Capital Gains: What You Need to Know

A capital gain occurs when you trigger a disposition event such as selling your crypto, swapping your crypto to another crypto, or spending it. The math for a disposition event is pretty simple. You calculate the proceeds of the transaction which is often referred to as the transaction value. For example if you sell 2 ETH for $4,000 total then the proceeds is $4,000. You then figure out the cost basis of the asset you sold. In this example, let’s say the cost basis on the 2 ETH was $3,000 total. You then follow this simple formula: Proceeds – Cost Basis = Capital Result. In the example this is $4,000 – $3,000 = $1,000 gain. You do math like this for every singular disposition event and once datasets start to scale in volume, I highly recommend not doing this by hand. Use a crypto tax software or create a custom script to handle all of the math.

What is also important in regard to capital gains is the determination of short-term vs long-term. A long-term capital gain occurs when you have held the asset for over 365 days (>365). If you have held the asset for 365 days or less (<=365), then a short-term gain occurs. Long-term gains have a lower tax rate compared to short-term and ordinary income. This is shown below.

Now that you’ve grasped the concepts of capital gains and losses, how to calculate them, and the distinctions between short-term and long-term gains, there’s one more crucial element to complete this mathematical puzzle – understanding how short-term and long-term gains interact with each other.

First, gains and losses within the same category aggregate together. If one category, whether short-term or long-term, incurs an overall loss, it aggregates with the other category. Conversely, if both categories yield positive results, they undergo tax bracket calculations separately. Furthermore, if the combined sum of both types results in a loss, you have the option to use up to $3,000 of that loss to offset other forms of income. Any surplus from this deduction can be carried forward to offset capital gains or income in future tax years.

To illustrate this interaction, here are some examples:

- $1,000 Short-Term Total Gain + (-$3,000) Long-Term Loss = (-$2,000) Overall Loss. This $2,000 loss can be used to offset other income with no roll forward.

- $15,000 Short-Term Loss + $4,000 Long-Term Gain = -$11,000 Overall Loss. $3,000 can be used to offset other income, and the remaining $8,000 carries forward as a loss for the next tax year.

- $2,000 Short-Term Gain and $1,500 Long-Term Gain = $2,000 added to your ordinary income total, and $1,500 is subject to the long-term tax brackets, which typically range from 0% to 20%.

Lastly, it’s crucial to understand the concept of roll forwards. If you have a loss carryforward, it can be applied against aggregated totals in future tax years. So, while claiming losses may seem inconsequential now, they can ultimately result in significant savings down the road.

Mastering Ordinary Income and Capital Gains: A Comprehensive Recap

In conclusion, understanding the intricacies of ordinary income and capital gains is essential in navigating the complex world of taxation, especially in the realm of cryptocurrency. Ordinary income encompasses various sources, including wages, salary income, and short-term investment earnings, all subject to tax calculations based on your tax bracket.

When it comes to cryptocurrency, ordinary income takes forms such as staking rewards, mining income, gambling winnings, airdrops, and service-related income, all treated similarly based on fair market value. Regardless of asset value fluctuations, it’s crucial to remember that your total income is subject to taxation.

To manage your tax liability effectively, consider selling a portion of received assets immediately upon acquisition to ensure you have the means to cover your tax obligations, even if asset values decline.

Switching gears to capital gains, the key is understanding the distinction between short-term and long-term gains, with long-term gains typically benefiting from lower tax rates. Calculating gains and losses involves straightforward math, with proceeds minus cost basis determining the capital result.

Finally, the interaction between short-term and long-term gains is crucial, with losses offsetting gains within the same category and opportunities for tax deductions if both categories yield losses. The concept of roll forwards further underscores the importance of strategic tax planning, as losses today can translate into significant savings in the future.

With this knowledge, you can navigate the complex terrain of ordinary income and capital gains, ensuring you optimize your tax strategy and financial well-being.