Table of Contents

Hello, readers! Today, we’re going to talk about something really important in the world of crypto taxes: the end of year holdings. But don’t worry; we’ll make it simple and easy to understand!

So, what is the end of year holdings, and why is it so crucial for anyone who does annual crypto reconciliations? Let’s find out!

What Are End of Year Holdings?

Imagine you have a piggy bank, and every month, you put some money in it. At the end of the year, you want to know how much money you’ve saved. The end of year holdings, in the world of crypto taxes, is the total you have at a certain point in time. It’s like checking how much money you have in your piggy bank at the end of the year.

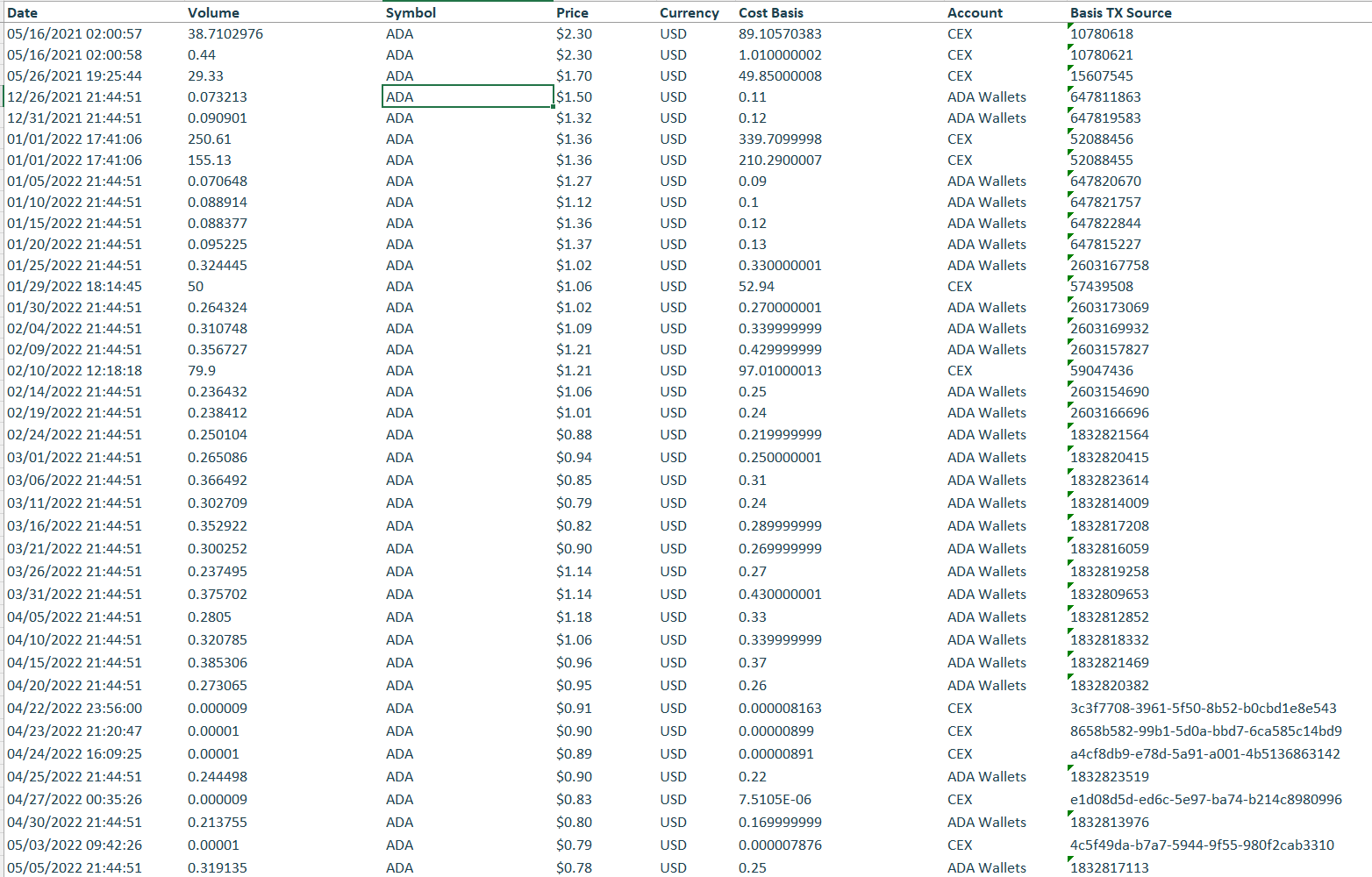

The end of year holdings is a special file that shows the total amount of crypto you have at the end of a year or a month. This file is usually created by a computer program or tax software and looks like a list with all your crypto in it. You can’t make this report by hand; it’s usually generated by tax software. An example of an end of year holdings is this:

Why Are End of Year Holdings So Important?

Now, let’s talk about why end of year holdings are so important, especially when you’re dealing with crypto taxes.

Think of the end of year holdings like a save point in a video game. When you’re playing a game, you reach a point where you save your progress so that if something goes wrong later, you can start from that saved point instead of going all the way back to the beginning.

In the world of crypto taxes, your end of year holdings are like that save point. Here’s why:

- Preventing the Need to Go Back in Time: Imagine you did a crypto reconciliation for the years 2018 through 2021. You filed your taxes accurately for each of those years. But then, something unexpected happens – you lose all your important data from those years!

- The Power of End of Year Holdings: Fortunately, you’ve been smart, and you have a copy of your end of year holdings from 2021 stored in a safe place. This is like having a backup of your game save. It means you don’t have to redo all the work for the years 2018 through 2021. You can start fresh from January 1, 2022, and continue your crypto tax journey using the 2021 holdings report as your starting point.

This way, you don’t have to worry about losing all your progress and can keep moving forward in your crypto tax adventure!

Wrapping Up

In simple terms, the end of year holdings in crypto tax land is like your safety net. It’s a way to make sure you don’t lose all your important information and progress when dealing with crypto data from different years.

So, the key takeaway is to always back up your end of year holdings report in a safe place. By doing this, you can save yourself from going back in time and revisiting past years’ data. Just like in a video game, having a save point can be a real lifesaver when dealing with crypto taxes!

Now you know why end of year holdings are so important in the world of crypto taxes. Keep this in mind as you continue to learn about the fascinating world of digital money. Happy crypto tax adventures!